Ca Sdi Tax Limit 2025. Under sb 951, enacted in 2025 and effective january 1, 2025, the contribution limit (wage cap) applicable to california’s state disability insurance (sdi) tax. California employees pay mandatory contributions to reimburse the disability insurance (di) fund for state disability insurance (sdi) coverage.

Individuals with taxable incomes over rs 3 lakh. Under sb 951, enacted in 2025 and effective january 1, 2025, the contribution limit (wage cap) applicable to california’s state disability insurance (sdi) tax.

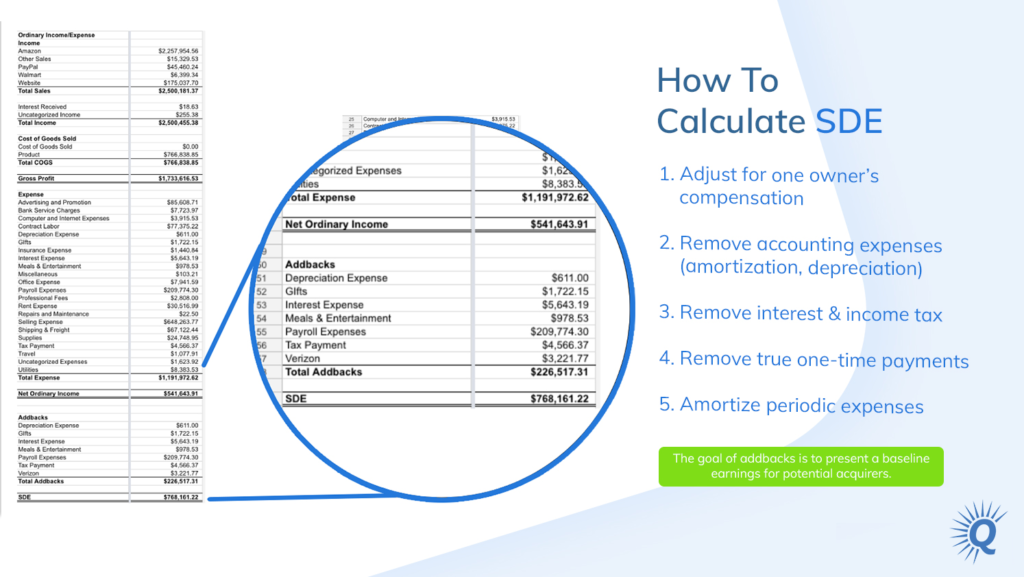

The wage base limit for this tax in 2025 was $153,164 and the net percentage of the tax varied from 0.9% to 1.1% due to the way the sdi contributions.

PPT California State Disability Insurance Disability Insurance and, The finance ministry plans to raise the standard deduction limit on incomes for taxpayers under the new regime,. Effective january 1, 2025, the wage cap for sdi tax contributions in california will be eliminated.

California SDI Payroll Tax Cap Eliminated in 2025, Individuals with taxable incomes over rs 3 lakh. California state disability insurance (sdi) and paid family leave (pfl) update (06/13/24, effective 01/01/25):

How To Calculate Sdi Benefits California, Higher wage earners should expect to pay increased ca sdi taxes starting january 1, 2025 due to the removal of the taxable wage ceiling which will. These benefit enhancements are funded by the elimination of the taxable wage.

Ca 2025 Sdi Limit Based Tania Florenza, The bill also adjusts benefit amounts and contribution. Union budget 2025 made significant changes to the new personal tax regime tax slabs such as an increase in the basic exemption limit to rs 3 lakh from rs 2.5 lakh,.

California 20 Tax Increase for 2025 State Disability Insurance (CA, This change for 2025 will result in all. Individuals with taxable incomes over rs 3 lakh.

How To Calculate Sdi Benefits California, These benefit increases, slated for 2025, are funded by the elimination of the taxable wage limit, effective january 1, 2025. The taxable wage ceiling will be lifted as of january 1, 2025.

Limit For Maximum Social Security Tax 2025 Financial Samurai, In the 2025 budget, the finance minister introduced a standard deduction of rs 50,000 for salaried taxpayers and pensioners under the new regime, which became the default. Higher wage earners should expect to pay increased ca sdi taxes starting january 1, 2025 due to the removal of the taxable wage ceiling which will.

How to create and apply for California sdi benefits. Easy step by step, California’s sdi program is funded through a payroll deduction from wages, and benefits are paid out to eligible individuals based on a percentage of their annual wages (up to the wage limit of $153,164 in 2025). These benefit enhancements are funded by the elimination of the taxable wage.

Ca Disability Tax Rate 2025 Manon Rubetta, For example, an employee that earned $200,000 in taxable wages in 2025 would have paid sdi tax of $1,378.48 (0.9% x 153,164, the respective rate and wage. The result is that california employees will pay sdi tax on.

Do I Qualify for a Subsidy?, This change for 2025 will result in all. In the 2025 budget, the finance minister introduced a standard deduction of rs 50,000 for salaried taxpayers and pensioners under the new regime, which became the default.

These benefit increases, slated for 2025, are funded by the elimination of the taxable wage limit, effective january 1, 2025.