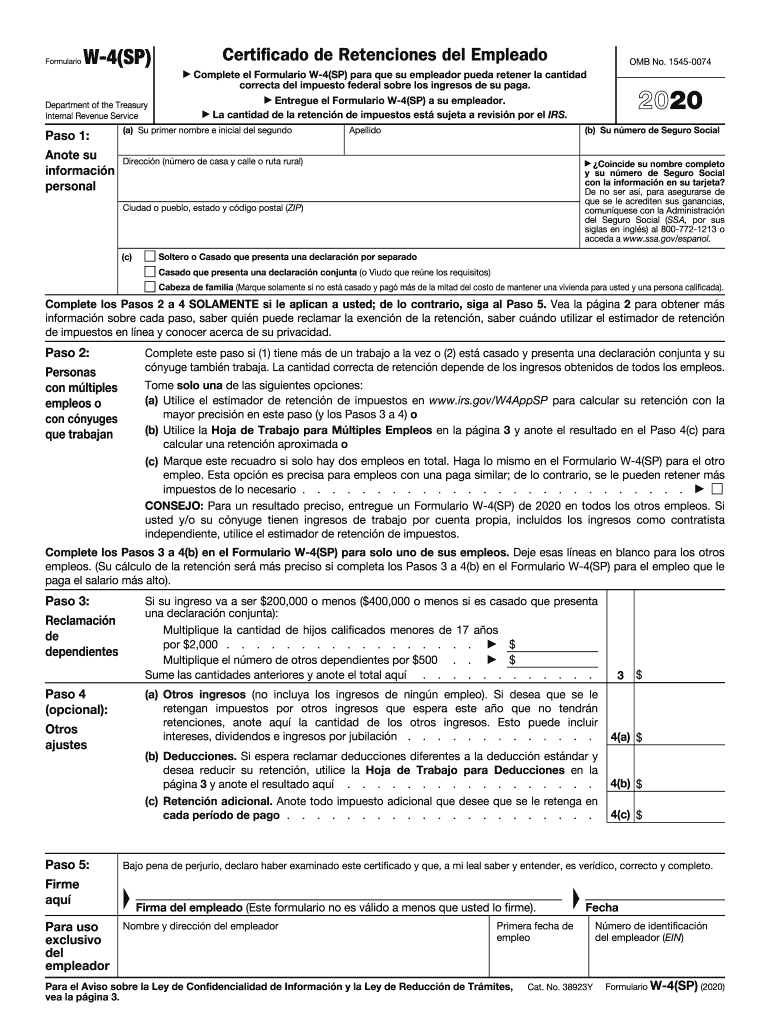

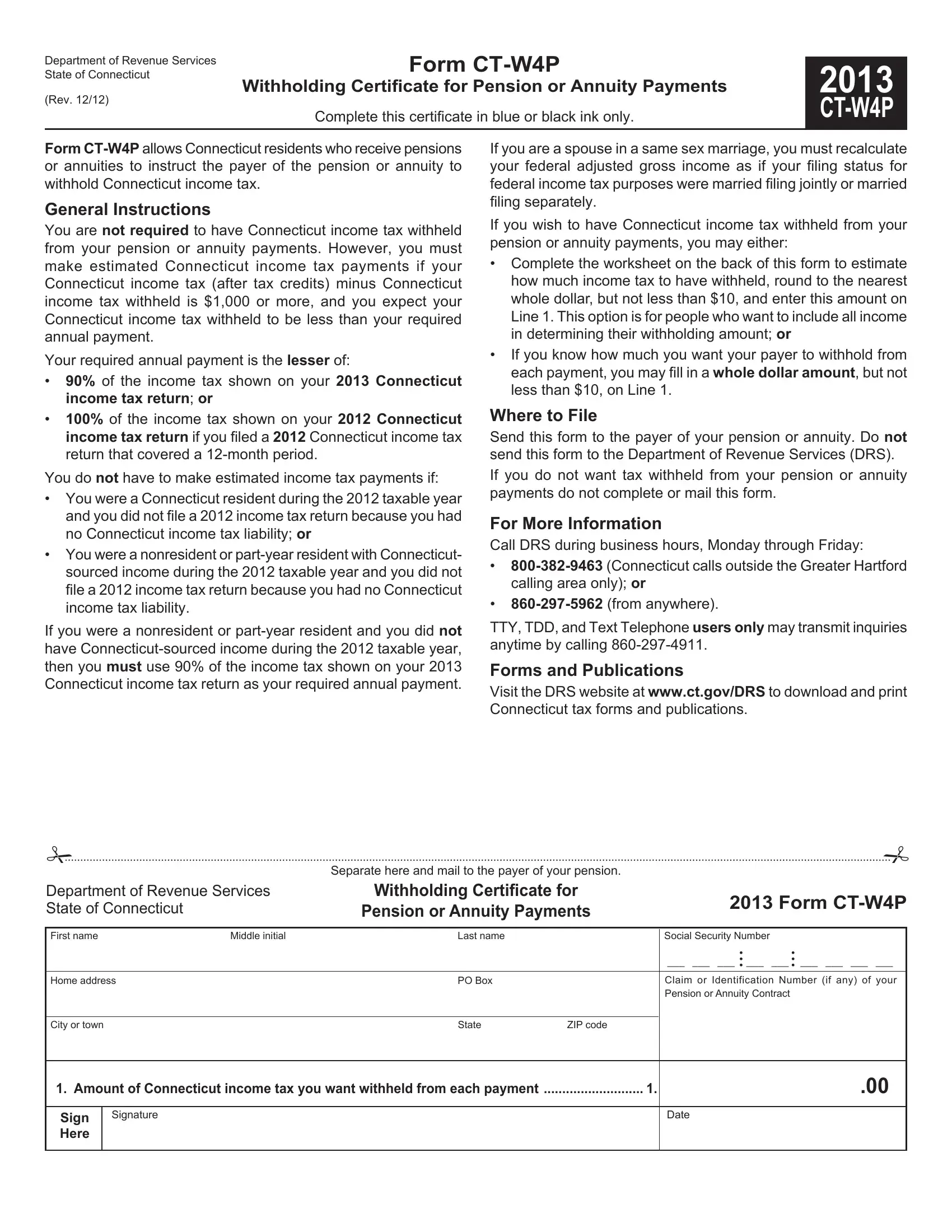

Ct W4p Form 2025. Voluntary withholding request from the irs' website. Form ct‑w4p is for connecticut resident recipients of pensions, annuities, and certain other deferred compensation, to tell payers the correct amount of connecticut.

Residents receiving taxable pension, annuity or other deferred distributions should be contacted by their plan administrator and provided with instructions as well as the newly. Form ct‑w4p is for connecticut resident recipients of pensions, annuities, and certain other deferred compensation, to tell payers the correct amount of connecticut.

CT CTW4P 20212022 Fill and Sign Printable Template Online US, Residents receiving taxable pension, annuity or other deferred distributions should be contacted by their plan administrator and provided with instructions as well as the newly. Pension or annuity withholding calculator.

Ct W4P Form ≡ Fill Out Printable PDF Forms Online, Form ct‑w4p is for connecticut resident recipients of pensions, annuities, and certain other deferred compensation, to tell payers the correct amount of connecticut. Here's a closer look at the tax cuts, who specifically benefits, and how:

Fillable Online W4p 2025 pdf. W4p 2025 pdf. W4p form 2025 pdf. Ctw4p, It is the payer who is responsible to withhold the. One million filers to benefit from income tax cuts:

Printable W4p Form Printable Forms Free Online, Use this form if you have an ira or retirement account and live in connecticut. This calculator is intended to be used as a tool to calculate your monthly connecticut income tax.

Irs Form W 4 Follow The Instructions To Fill It Without Errors Gambaran, Residents receiving taxable pension, annuity or other deferred distributions should be contacted by their plan administrator and provided with instructions as well as the newly. Mail or fax us a request to withhold taxes.

W 4p Fill out & sign online DocHub, Although this form is made available to you by ct drs, the form must be submitted directly to your pension payer, not to drs. Mail or fax us a request to withhold taxes.

W4P Form 2025 2025, Residents receiving taxable pension, annuity or other deferred distributions should be contacted by their plan administrator and provided with instructions as well as the newly. Form ct‑w4p is for connecticut resident recipients of pensions, annuities, and certain other deferred compensation, to tell payers the correct amount of connecticut.

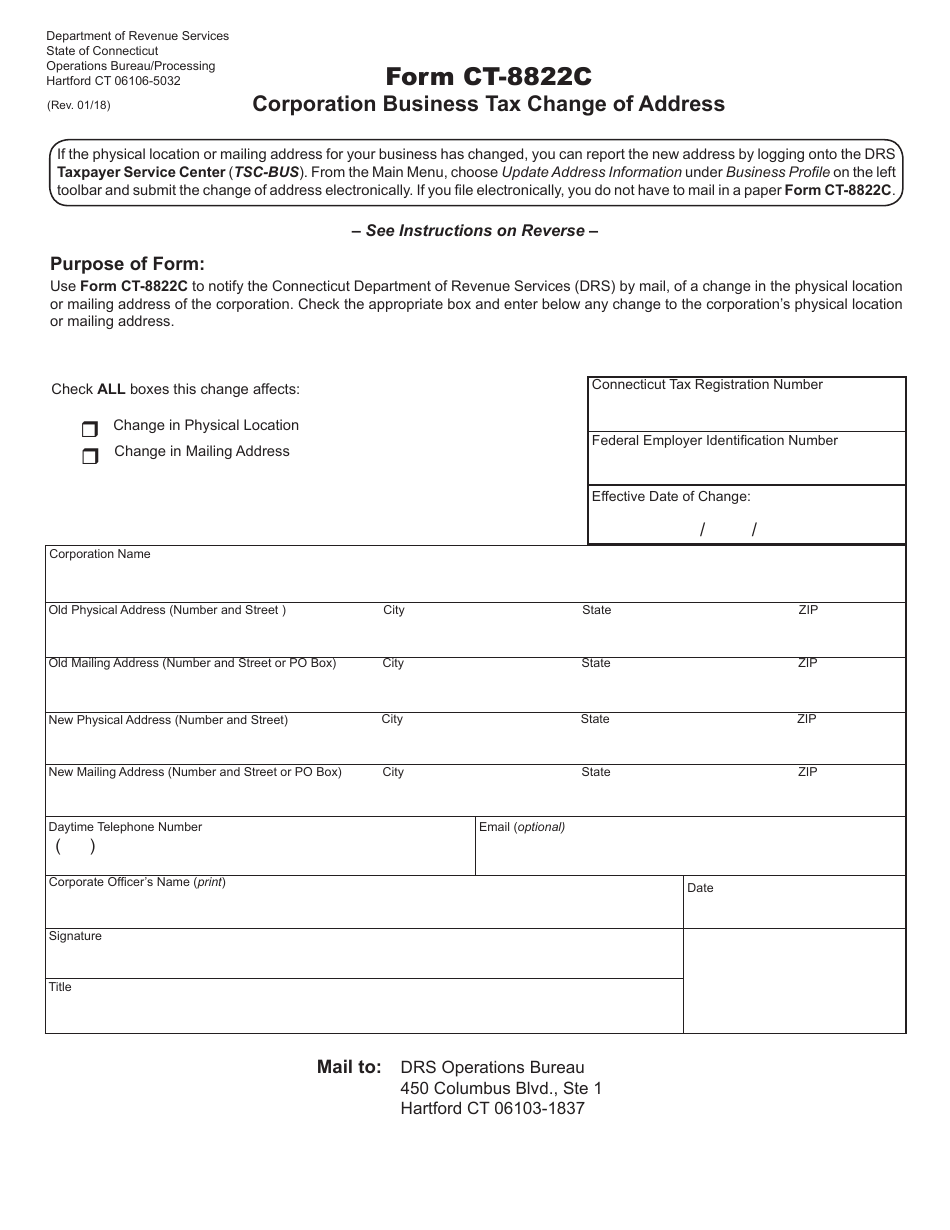

Form CT8822C Fill Out, Sign Online and Download Printable PDF, Then, find the social security office closest to your home. Mail or fax us a request to withhold taxes.

Ct W4P Form ≡ Fill Out Printable PDF Forms Online, Underpayment of estimated income tax by individuals, trusts, and estates. Although this form is made available to you by ct drs, the form must be submitted directly to your pension payer, not to drs.

Ct W4P Form ≡ Fill Out Printable PDF Forms Online, Pension or annuity withholding calculator. You may change it at any.

Form ct‑w4p is for connecticut resident recipients of pensions, annuities, and certain other deferred compensation, to tell payers the correct amount of connecticut.