Georgia Income Tax Brackets 2025. It includes applicable withholding tax tables, basic. Georgia utilizes a relatively simple progressive income tax system, with rates ranging from 1.00% to 5.75%.

On january 1, 2025, georgia transitions from a graduated individual income tax with a top rate of 5.75 percent to a flat taxan income tax is referred to as a “flat tax” when all. Published 10:59 pm pdt, april 4, 2025.

The Ultimate Guide to State Taxes Atlanta Tax Attorney, If the proposal is approved, the tax rate for 2025. The tax rate is set to decrease each year until it reaches 4.99%, but changes can be delayed.

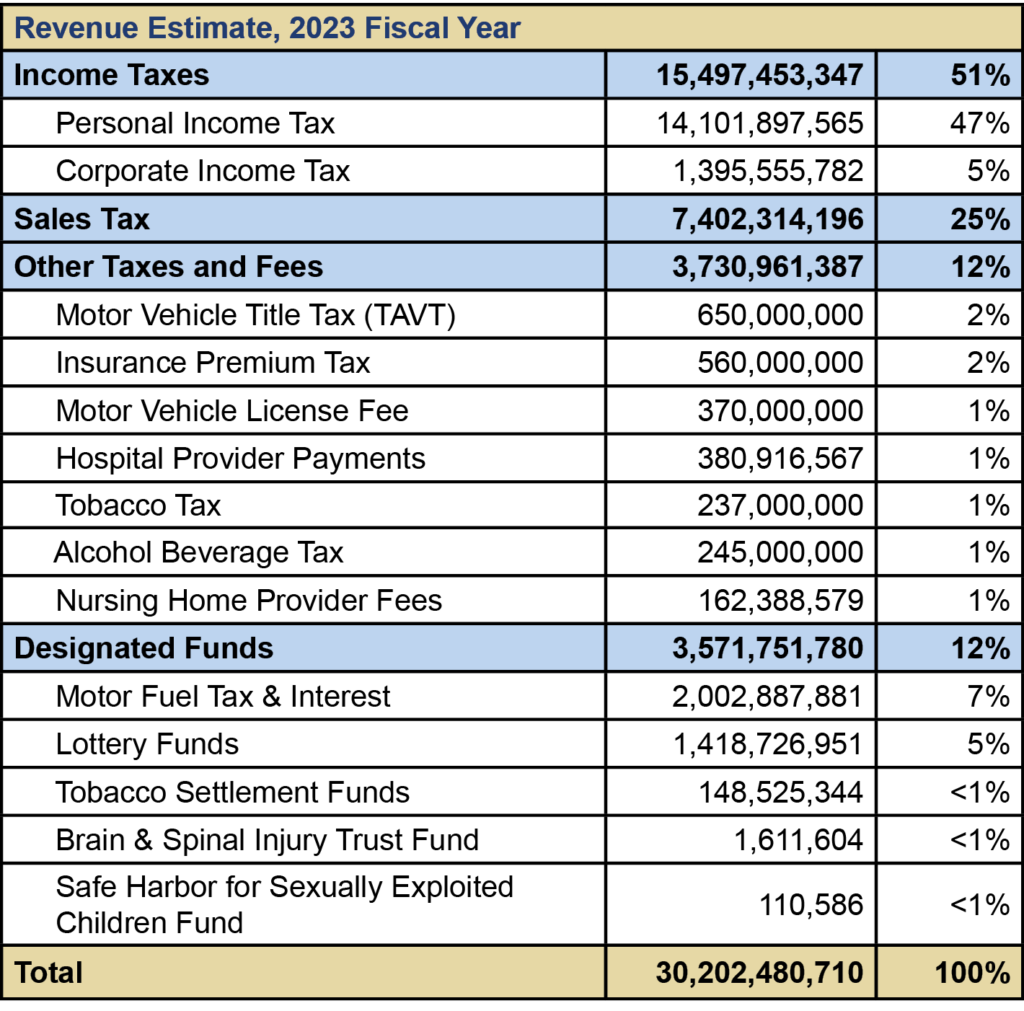

Revenue Primer for State Fiscal Year 2025 Budget and, 5.49% • january 1, 2025: Assuming delays are not required, following is the personal income tax rate schedule for january 1, 2025 to january 1, 2029:

2025 State Tax Brackets Latest News Update, For 2025 (tax returns filed in 2025), georgia has six state income tax rates: Georgia utilizes a relatively simple progressive income tax system, with rates ranging from 1.00% to 5.75%.

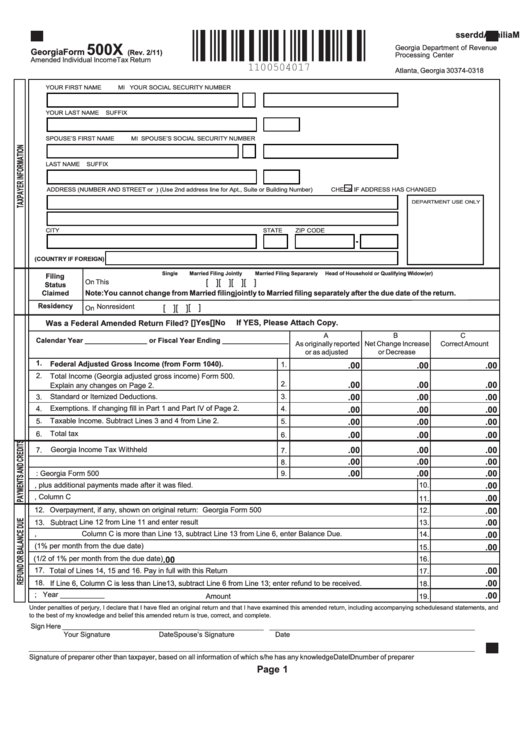

Individual Tax Withholding Form, Georgia residents state income tax tables for married (separate) filers in 2025 personal income tax rates and thresholds (annual) tax rate taxable income threshold; This tool is designed for simplicity and ease of use, focusing solely on income.

Tax Brackets 2025, State income taxes are due april 15, 2025. Georgia residents state income tax tables for married (separate) filers in 2025 personal income tax rates and thresholds (annual) tax rate taxable income threshold;

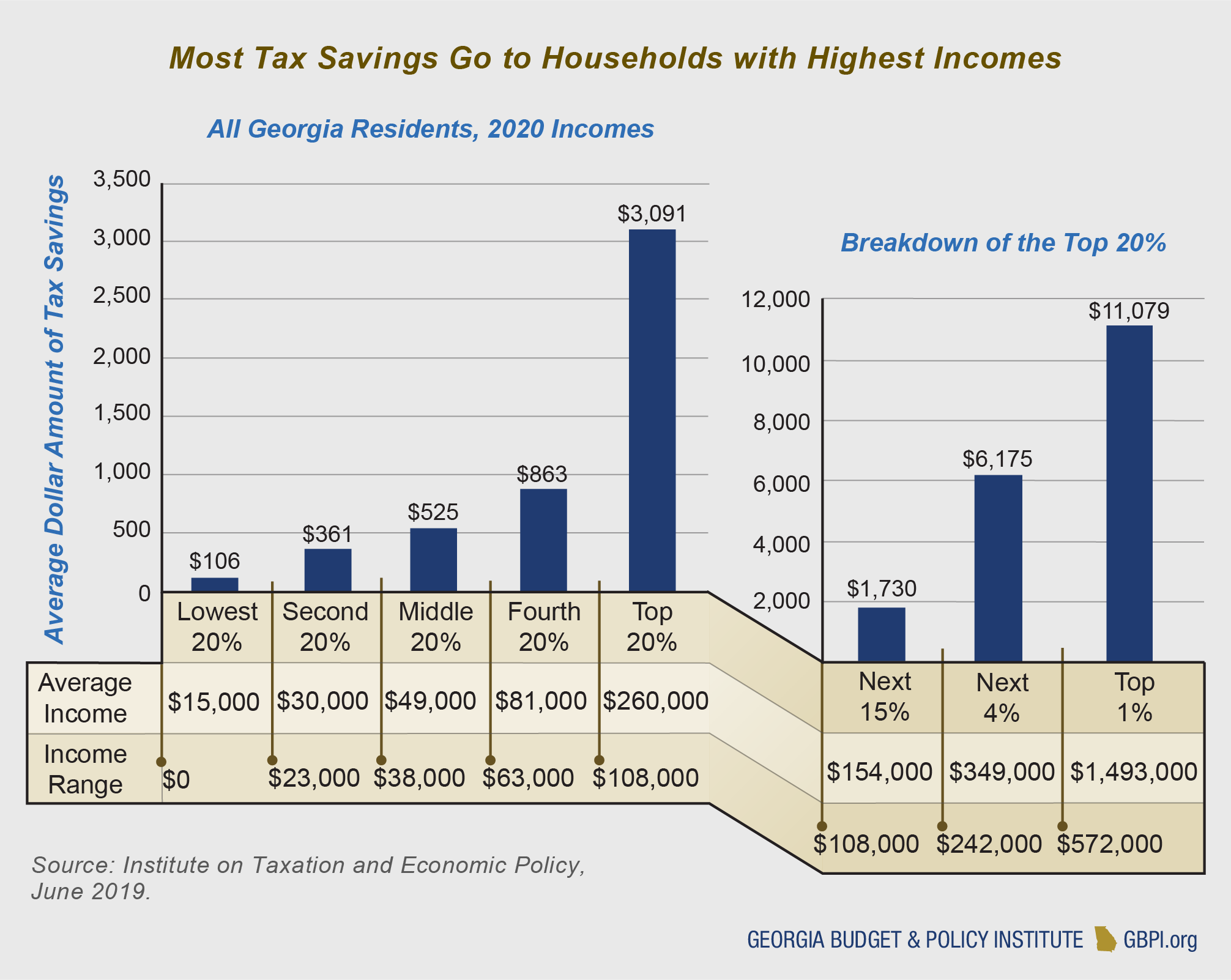

Lawmakers Might Come to Regret Risky Tax Plan, Higher earners pay higher rates, although georgia’s brackets top out at. For 2025 (tax returns filed in 2025), georgia has six state income tax rates:

The Tax Cuts and Jobs Act in High Households Receive, Assuming delays are not required, following is the personal income tax rate schedule for january 1, 2025 to january 1, 2029: This page has the latest georgia brackets and tax rates, plus a georgia income tax calculator.

Revenue Primer for State Fiscal Year 2025 Budget and, Right away, the scheduled changes would consolidate the six income tax brackets into two in 2025 and remain that way until 2032, when a flat tax would be. Georgia residents state income tax tables for married (separate) filers in 2025 personal income tax rates and thresholds (annual) tax rate taxable income threshold;

2025 Tax Brackets The Best To Live A Great Life, Assuming delays are not required, following is the personal income tax rate schedule for january 1, 2025 to january 1, 2029: Higher earners pay higher rates, although georgia’s brackets top out at.

Az Tax Brackets 2025 Arlena Olivia, For 2025 (tax returns filed in 2025), georgia has six state income tax rates: Georgia’s 2025 withholding methods use a flat tax rate of 5.49%.

Must Have Shoes 2025. Whether they're fitted boots like at ferragamo or slingback. Changes were afoot for the spring/summer 2025…

Average Cost Of Living 2025. Cost of living index 2025 new york, ny prague sydney london berlin beijing delhi rio…

Trauma Conference 2025 Boston. Trauma and mental health in forcibly displaced populations; Trauma conferences in boston 2025/2025/2026 is an indexed…